Gold – only a piece of metal, yet holds

worth,

beauty, and power that is unmatched by any other metal in the world. It has been the center of

attraction to humans due to its malleability, intrinsic beauty, and virtual indestructibility.

For civilizations, it has been beaten, tampered, melted, and transformed into various jewelry,

ornaments, and tools, but continues to hold great worth even today.

With its trade origins dating back to 600BC, gold has been used for a long time, initially,

as a currency. It was only recently, in 1933, that the Gold Standard (a monetary system where

the value of paper money is backed directly by gold) was abandoned, and entirely replaced by

fiat money.

Now gold maintains its regulatory system aloof from the currency and is traded in stocks, bonds,

certificates, or physically by investors around the world. These investors can be the central

banks of different countries, gold dealers, investment firms, or individual people like us.

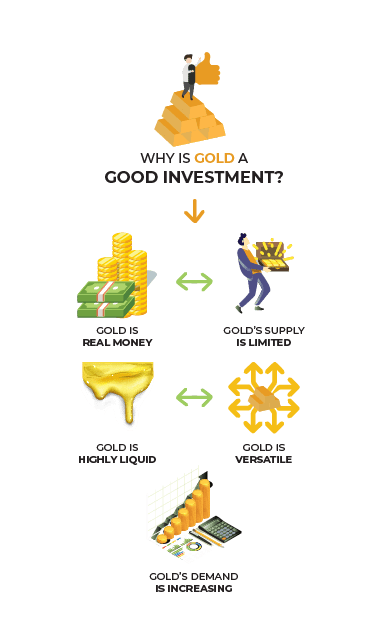

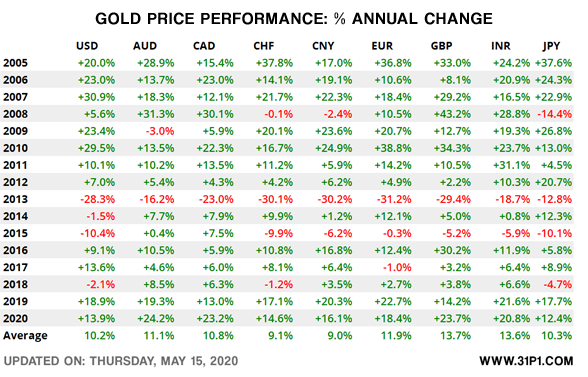

The gold bar price fluctuates throughout the day due to the changes in demand and supply and

is not affected by the changes in the debt or equity market as gold has a separate regulatory

system. If an investor wants to invest in physical gold, the gold bar price in US varies from

dealer to dealer and often sold at a premium due to the production and transportation costs

associated with the bar.

Owing to the liquid nature of gold, people can buy gold easily for two reasons: hedging risks

or increasing wealth. Investors look for best place to buy gold online to make gold purchases,

in order to hedge their portfolio risks and to cope in times of economic uncertainties.

Others purchase gold to improve their wealth and to provide for themselves a financial

cushion in times of emergencies.

To physically own gold, you can buy gold as gold jewelry, gold bullions (bars and coins),

gold certificates, digital gold, gold ETFs (Exchange Traded Funds), or as shares in a

gold mining company. Some of these instruments are speculative and therefore are a

risky investment.

For a risk-free investment in gold, it is recommended that you buy gold bars. You can buy

gold bars of 1 gram, 5 grams, 10

grams, half oz, and gold per ounce from 31p1.

Being one of the reliable and the most reputable gold dealers, 31p1 offers only the purest 0.9999,

24 carat gold to its customers at an affordable price, making it the best place to buy gold

online in USA.