The ongoing COVID-19 pandemic has kept everyone up on their toes and has instilled fear and anxiety globally. Following the lockdown, social distancing and quarantine, people are experiencing somewhat similar crises like The Great Depression of 1930 and the Financial crises of 2008. Industries have come to a halt since the announcement by the WHO, declaring COVID-19 as a contagious disease and a pandemic, after which governments all over the world have taken precautionary measures against the spread of this disease whose cure is unknown till date.

Current Corona Virus Update (April 06, 2020, 08:33 GMT):

Total Coronavirus Cases in US: 336,851

Deaths: 9,620

Recovered: 17,977

Source: https://www.worldometers.info/coronavirus/country/us/

The sudden shutdown of Factories, offices, and even local grocery stores have acutely affected the global economy and has created a lot of uncertainty in the financial markets, which in turn created panic amongst investors. Now, in hindsight, investors have always looked up to Gold as a safe haven in economic crises and lead to the usual surge in its price.

However, gold prices see-sawed over the course of the last two months. Here’s what happened. Spot gold prices rose by 0.6 per cent to $1,632.02 per ounce on 12th March 2020 as concerns emerged regarding the economic impact from COVID-19.

On 17th March 2020, Gold prices tumbled 3% as fear of the spread of the Corona Virus led to the shutdown of economic activities and prompted investors to hoard cash by dumping most of their liquid assets.

OANDA analyst Craig Erlam made a statement that “Cash and bonds are king right now. It’s just the place where investors are seeing value in terms of what they hold.“

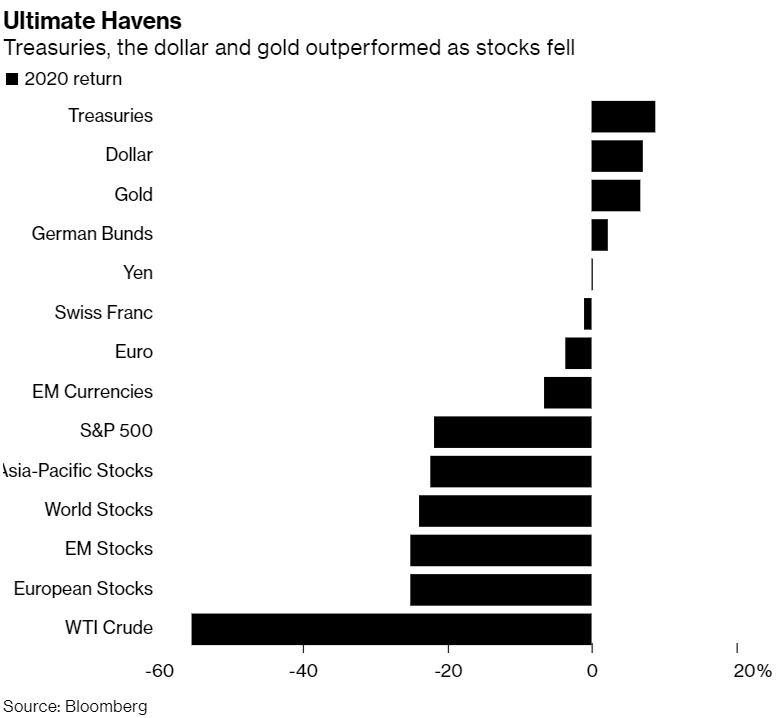

Fast forward to April; gold prices have now been up, along with treasuries and dollar. It has once again regained its haven status and that investors are now purchasing Gold to hedge their risks in this financial crisis. Once again, gold bugs are bragging about their correct predictions about this economic downturn.

Jim Rickards, the author of several books, predicted this financial crisis and asked people to hold Gold as a precaution of wealth reservation. Moreover, the coolest thing about Gold is that it is the best bet against other generalized risks and proves to be the most liquid commodity to trade with and also that the default risk in holding this precious metal is zero.

As the predicted happened, and the world is currently facing the consequences of this economic decline, advisors are pushing investors to buy gold as the safest bet as the prices will increase in the future. Chief Investment Officer Ruiz said that “Gold might be one of the options to diversify your portfolio“. Moreover, commodity investor Jim Rogers informed Economic Times by phone from Singapore that Gold is going to go up a lot and that “Whenever people lose confidence in money and governments, they always buy gold and silver.” – Bloomberg

It seems clear by now that Gold maintains its ultimate haven status in financial difficulties as it proves to be the most liquid asset for investors to cover their losses in other asset classes. However, it also remains an unpredictable subject to the volatility in dollar and oil prices. Rest assured, Gold is currently the lucrative asset for investors to hedge their risks and earn money.